child tax credit september 2020

Have been a US. It is in addition to the credit for child and.

Irs Finalizes Updates To Form 941 For Covid 19 Tax Credits Integrity Data

Child Tax Credit overall decreased poverty.

. A portal to update bank details and facilitate payments. The 2020 Child Tax Credit is intended to help offset the tremendous costs of raising a child or children. For additional questions and.

For more information go to CCB young child supplement. IR-2021-188 September 15 2021. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021.

September 20 2022. To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have. Filed a 2019 or 2020 tax return and.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families are now. 6 min read. Census Bureau data released on September 13 the US child poverty declined 46 from 97 in 2020 to 52 in.

Millions of families across the US will be receiving their third. Wait 5 working days from the payment date to contact us. December 13 2022 Havent received your payment.

Quarterly estimated tax payments are still due on April 15 2021. Child Tax Credit Update. Families must have at least 3000 in earned income to claim any portion of the credit and can receive a.

The child tax credit CTC will return to at 2000 per child in 2022. Your child tax credit payments will phase out by 50 for every 1000 of income over those threshold amounts according to joanna powell. Child Tax Credit CTC This credit is for individuals who claim a child as a dependent if the child meets additional conditions described later.

Making a new claim for Child Tax Credit. 1200 sent in April 2020. The Differential Effects of Monthly Lump-Sum Child Tax Credit Payments on Food.

The amount you can get depends on how many children youve got and whether youre. The Child Tax Credit provides money to support American families. Child tax credit september 2020.

Ens of millions of people in the United States will have their monthly Child Tax. If you qualify the credit can be worth up to 2000 per child for Tax Years 2018-2025 in 2017 and earlier Tax Years. Total child tax credit payments between 2021 and 2022 could be up to 3600 per kid.

You and your spouse or common-law partner must file your 2019 and 2020 tax returns to get all four payments. The Child Tax Credit is one of the largest federal investments in children. The federal tax filing deadline for individuals has been extended to May 17 2021.

The current scheme allows families to claim up to 3600 per child under. Who is Eligible. Already claiming Child Tax Credit.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors. It is a partially refundable tax credit if you had earned income of at least 2500. Through the 2021 Enhanced Child Tax Credit families were able to receive 3600 for children under 6 years of age and up to 3000 for children between ages 6 to 17.

Child tax credit payments are due to come in on the 15th of each month Credit. Enhanced child tax credit. So In July I called to unenroll from it and the lady said my husband and I werent eligible to recive it but that she would put it that I called to unenroll but last week I recived a.

State Historic Tax Credits In The Year 2020 Novogradac

Monthly Tax Credit For Children From Irs When Will You Get It Wusa9 Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Claim The Child Tax Credit For A Baby Born In 2021 Goodrx

Federal Child Tax Credit Program Boosts Thousands In Tennessee Tennessee Lookout

Child Tax Credit United States Wikipedia

Saas Startups 3 Best Practices For Documenting R D Tax Credits With Git Data

Irs Child Tax Credit Issues Reported With September Payments Kvue Com

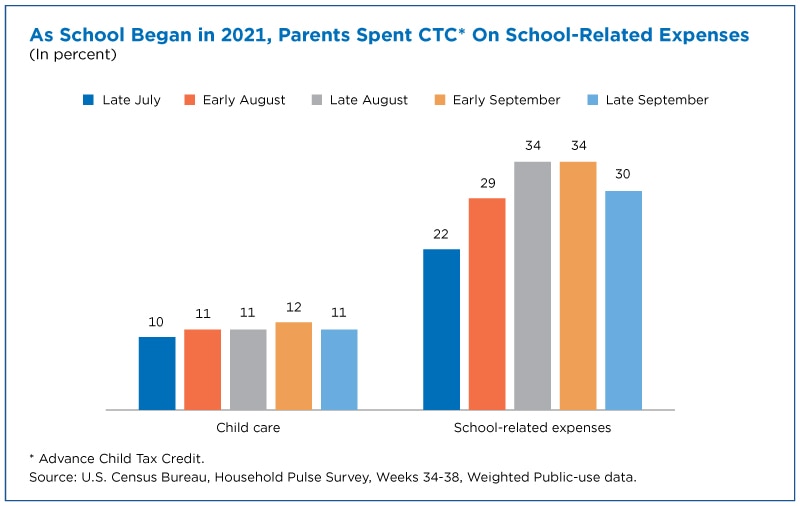

Nearly A Third Of Parents Spent Child Tax Credit On School Expenses

American Rescue Plan Tax Changes Child Tax Credit Tax Foundation

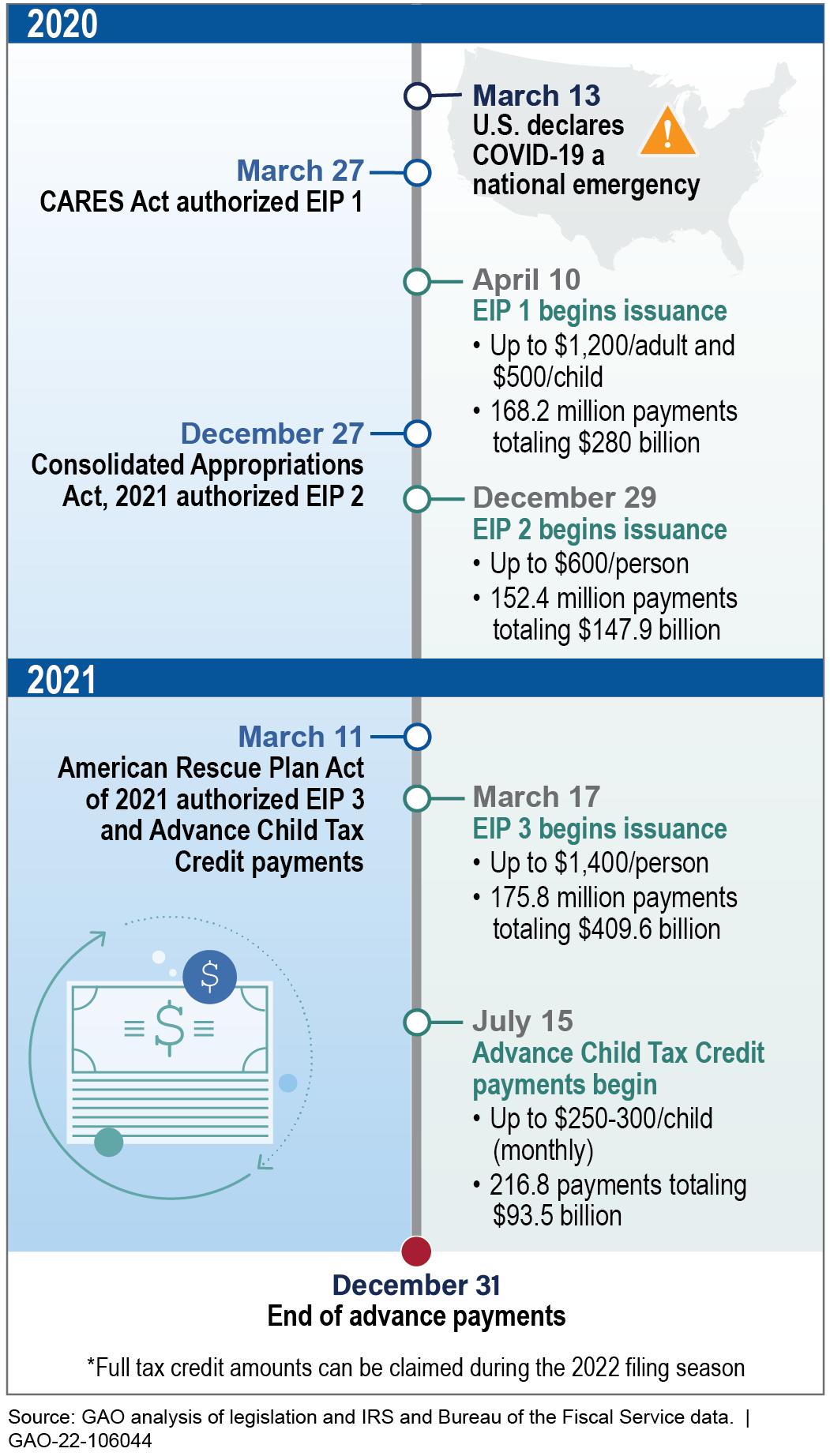

Stimulus Checks Direct Payments To Individuals During The Covid 19 Pandemic U S Gao

Understanding Economic Impact Payments And The Child Tax Credit National Alliance To End Homelessness

Deadline To Opt Out Of September Child Tax Credit Payment Is Monday Here S How To Cancel It Fingerlakes1 Com

Child Tax Credit September Payments Arriving In Parents Bank Accounts Cbs Detroit

Optima Newsletter Archives Optima Tax Relief

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

The 2021 Child Tax Credit Implications For Health Health Affairs

Low Income Housing Tax Credit Ihda

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back