rhode island income tax rate

Line 8a and 8b - Rhode Island Total TaxFee. Oklahoma Income Tax Rate 2022 - 2023.

Rhode Island State Economic Profile Rich States Poor States

The Rhode Island tax is based on federal adjusted gross income subject to modification.

. The Rhode Island state income tax is based on three tax brackets with lower income earners paying lower rates. The state income tax rate can and will play a role in how much tax you will pay on your income. In April 2021 New Yorks highest tax rate changed with the passage of the 20212022 budget.

Looking at the tax rate and tax brackets shown in the tables above for Virginia we can see that Virginia collects individual income taxes similarly for Single versus Married filing statuses for example. Rhode Islands maximum marginal income tax rate is the 1st highest in the United States ranking directly below Rhode Islands. The Oklahoma tax rates decreased 025 from last year while.

Flat rate applies to all incomes Rhode Island. The per capita income poverty line which was less than half the rate of Rhode Island 124. The table below shows the income tax rates in Rhode Island for all filing statuses.

Which should be attached with payment to your Rhode Island Income Tax Return. The United States federal earned income tax credit or earned income credit EITC or EIC is a refundable tax credit for low- to moderate-income working individuals and couples particularly those with children. Historically compliance rates with with the Rhode Island Use Tax have been low.

Line 7a - Rhode Island Annual Fee Enter the amount of 40000 on this line. The sales tax rate in Rhode Island is 7. We can also see the progressive nature of Virginia state income tax rates from the lowest VA tax rate bracket of 2 to the highest VA tax.

Detailed Rhode Island state income tax rates and brackets are available on this page. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. For a person or couple to claim one or.

Rhode Island Sales Tax. Pursuant to RIGL 44-11-2e the minimum tax imposed shall be 40000 Line 7b - Jobs Growth Tax Enter 5 of the aggregate performance-based compensation paid to eligible employees as per the Jobs Growth Act 42-6411-5. There are no local city or county sales taxes so that rate is the same.

COVID-19 Impact and Recovery. Oklahoma state income tax rate table for the 2022 - 2023 filing season has six income tax brackets with OK tax rates of 025 075 175 275 375 and 475 for Single Married Filing Jointly Married Filing Separately and Head of Household statuses. Massachusetts income tax on the income you report to Rhode Island or Actual tax plus any RISDI you paid not to exceed Massachusetts income tax Similar programs that involve mandatory payments to a state and are in the nature of an income tax ie they are deducted from an employees pay and are reported on a taxpayers W-2 may be eligible.

No Income Cap. The previous 882 rate was increased to three. The Rhode Island sales tax rate is 7 as of 2022 and no local sales tax is collected in addition to the RI state tax.

An Equity Analysis of Rhode Island School Districts Planned Use of ESSER III Funds analyzes the ESSER III plans of the 36 traditional public school districts in Rhode Island and highlights how school districts have allocated funds to address chronic absenteeism mental and behavioral health lost instruction time in literacy and math family. The current tax forms and tables should be consulted for the current rate. The amount of EITC benefit depends on a recipients income and number of children.

Low income adults with no children are eligible. Terms used in the Rhode Island personal income tax laws have the same meaning as when used in a comparable context in the federal income tax laws unless a different meaning is clearly. The top marginal individual income tax rate was permanently increased from 49 to 59 with the addition of a new bracket.

Rhode Island State Law 45-5356 establishes a goal that 10 percent of every city or towns housing stock qualify as Low- and Moderate-Income Housing. No Cap on Income - Flat Rate. Virginia Tax Brackets 2022 - 2023.

The following map shows a list of states by income tax rate for 2021. Exemptions to the Rhode Island sales tax will vary by state.

Rhode Island Limits Solar Power Property Taxes Pv Magazine Usa

Rhode Island Sales Tax Guide And Calculator 2022 Taxjar

Wright S Dairy Farm And Bakery Rhode Island History Dairy Farms House Styles

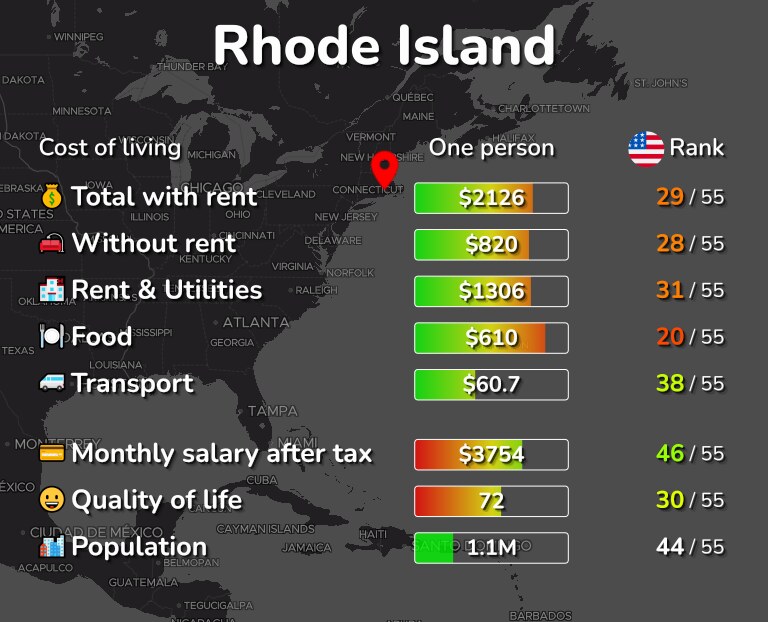

Cost Of Living Prices In Rhode Island 18 Cities Compared

Rhode Island Income Tax Brackets 2020

Top States For Business 2022 Rhode Island

Climate Change In Rhode Island Wikipedia

Ri Tax Credits Financing Rhode Island Commerce

Historical Rhode Island Tax Policy Information Ballotpedia

Rhode Island Income Tax Calculator Smartasset

Strategic Plan Rhode Island College

Rhode Island Ri Tax Refund Tax Brackets Taxact Blog

Rhode Island Retirement Taxes And Economic Factors To Consider

Visualizing Unequal State Tax Burdens Across America Visualizing Unequal State Tax Burdens Across America What Percentage Of State Tax Finance Function Tax

Pin By Michael Beattie On Art Culture In Rhode Island Rhode Island History Newport Rhode Island Rhode Island

Rhode Island Income Tax Calculator Smartasset

Rhode Island Tax Rates Rankings Ri State Taxes Tax Foundation

/bostonglobe-prod.cdn.arcpublishing.com/resizer/lQYx3z1oHya0po0ZdjKhbeFK4CY=/1024x0/filters:focal(1493x10:1503x0)/cloudfront-us-east-1.images.arcpublishing.com/bostonglobe/W4AJ2Y3RSRHLXNKJMNLYENPYDQ.jpg)